Preferential Policy

Investment Services

Commerce and trade

Commerce and trade Medical

Medical Gastronomy

Gastronomy Training

Training Fire fighting

Fire fighting Entertainment

EntertainmentPark will realize access of water, drainage, electricity, communications, road and land formation to create entering park conditions, establish commerce, health care, fire protection, training, catering, entertainment and other facilities, providing plants, warehouses, industrial land, living room for rent or sale.

Park Management Committee provide policy and legal advice, investment and work permits, business registration and registration, customs declaration, commodity inspection, warehousing and transportation, business exhibitions, coordination with local government and agency intermediary services and security services for the entering park enterprises. Investment a coordinated process

One-stop investment

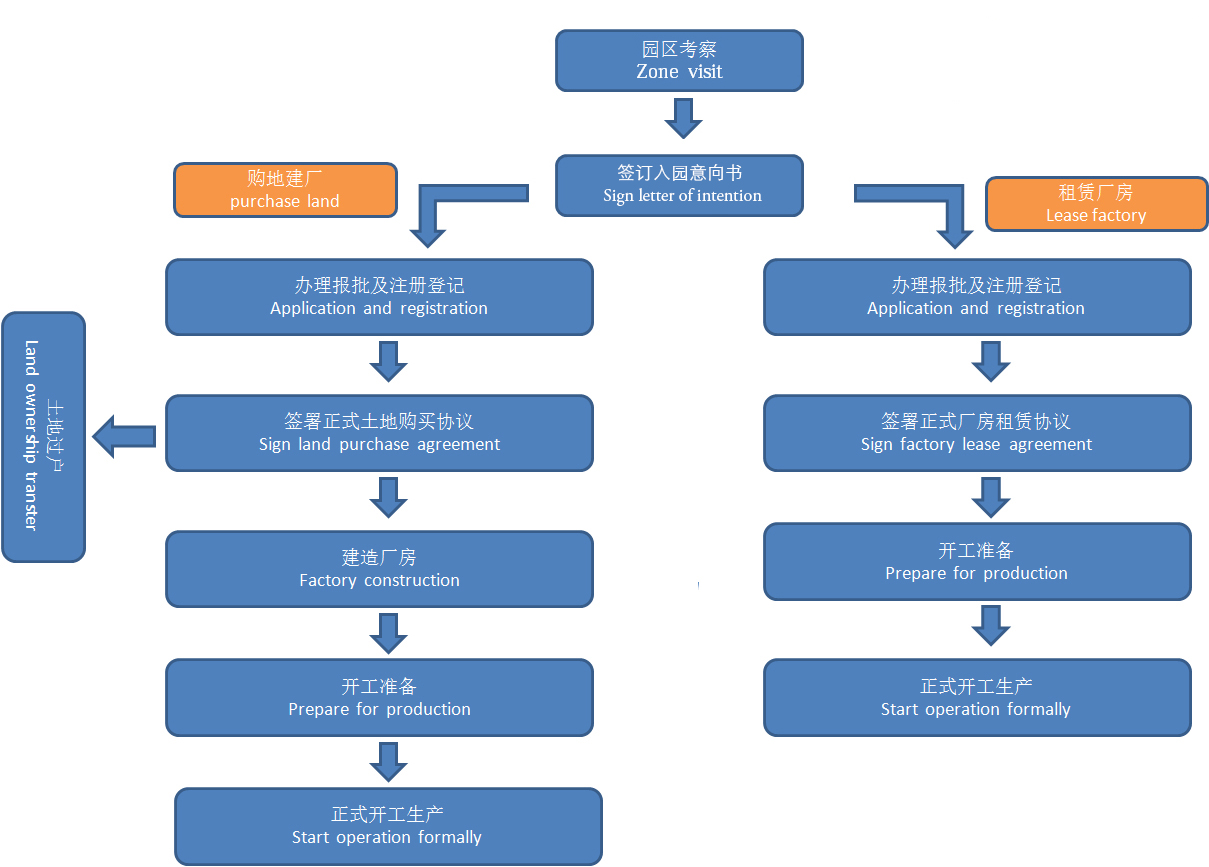

Stationed Way

InvestmentQ & A

QHow is the geographical environment in Uganda?

AUganda is located in eastern Africa, is a landlocked country across the equator. Land area is 241,500 square kilometers and population is 38 million. Most of land in Uganda is plateau with an altitude of 900-1500 meters and mild climate, there are many lakes, abundant rainfall, dense vegetation, it is hailed as 'Pearl of Africa' by Churchill.

QWhat are the advantages of investing in Uganda?

ALocated in the center of East Africa, the geographical position is superior, the products can radiate the surrounding countries; four seasons is just like spring and the climate is pleasant; politics is stable and has long-term good relations with China; degree of economic liberalization is high, there are no industry and investment restrictions for foreign investment, capital can enter and exit free with convertible currencies; high population density and low labor costs with huge market potential; sound investment and business law; as members of the East African Community and the Common Market for South-East Africa, Uganda's products enjoy preferential treatment when entering other member countries.

QWhich areas does the government encourage investment?

A① Agricultural products processing industry. Uganda has the advantage of developing agro-processing industry and the government attaches great importance. ② Mining. The government encourages and requires the processing of ore raw materials to increase the added value of exports. ③Tourism. Uganda's tourism industry has great potential for development. The government is stepping up efforts to promote and increase infrastructure investment to promote the development of the tourism industry. ④ Information and communications industry. Investment in the industry can create a lot of jobs.

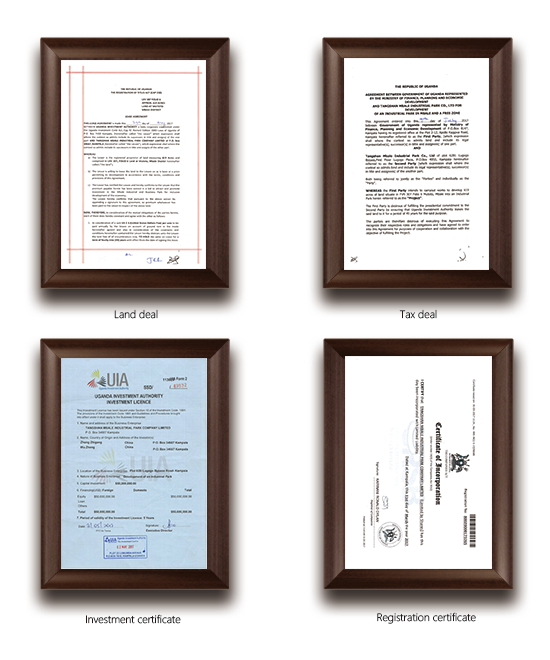

QHow about the provisions of Foreign-funded enterprises obtaining the land?

AAccording to the Ugandan Land Law, there are two main forms of land ownership: the right to use permanent and tenancy form. Permanent ownership is limited to country and Ugandan citizens, foreigners cannot buy land in Uganda, but can get land use rights up to 99 years. There are two types of lease terms, short-term lease (less than 5 years) and long-term lease (5-99 years). At present, the service life of land in the park is 49 years, and it can be extended to 99 years during the development period.

QHow about the wages in Uganda?

AUganda is one of the countries with the lowest wage rates in the world. Differences areas, occupations and gender can lead to wage differences. The average monthly wage of ordinary workers is 400-500 yuan. The proportion of social insurance payment is 15% of the employee's monthly salary, of which 5% is paid by employees and 10% is paid by employers.

QWhat is the main tax and tax rate in Uganda?

AUganda's state administration of taxation is the qualified institution of government administration and tax collection authorities, the tax bureau set up the Internal Revenue Service, the Customs Department and the Bureau of Investigation and so on to manage various taxes, the main taxes include corporate and personal income tax, customs duties, urban construction tax, withholding tax, value added tax, consumption tax and stamp duty.

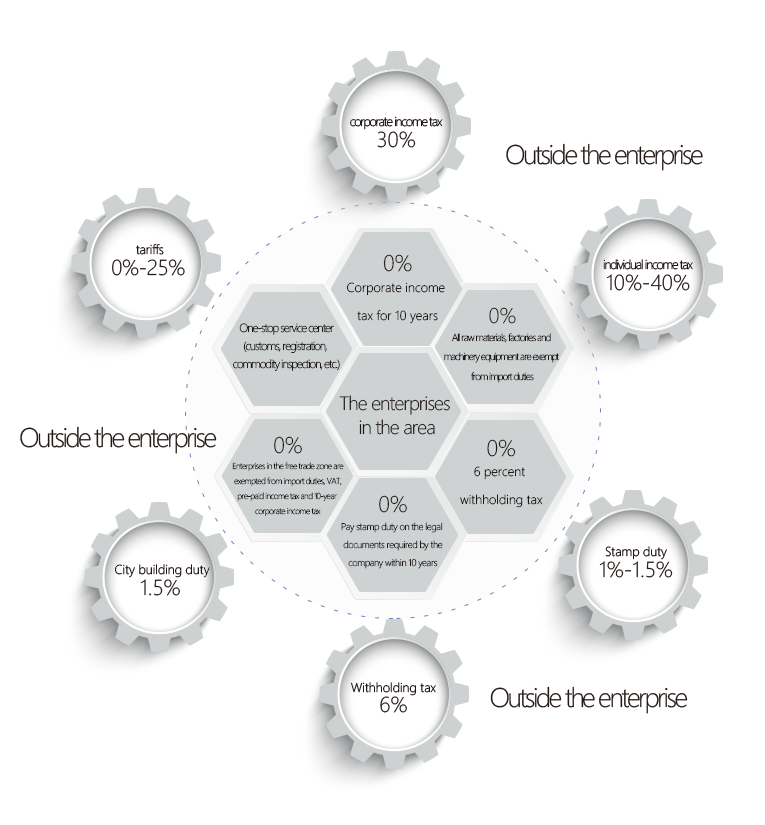

【Enterprise and personal income tax】 In Uganda natural person needs to pay income tax. According to the Uganda tax law, natural persons who need to pay income tax include individuals, partners, companies, trust funds and so on. The corporate income tax rate is 30%. The personal income tax threshold is 235,000 Ugandan shilling (about $ 65) a month, with a progressive tax rate of 10%, 20%, 30% and 40%.

【Tariffs, Urban Construction Taxes and Withholding Taxes】 The import stage involves import duties, urban construction tax and withholding tax. According to the different types of goods, tariff rates ranges from 0-25%, urban construction tax is 1.5%, withholding tax is 6%.

【Value Added Tax】 Companies with taxable annual sales of more than 150 million shunts (about $ 41,500) are considered general taxpayers and are subject to VAT registrations and a monthly VAT declaration. The VAT rate is 18%.

【Consumption Tax】 tax rates vary greatly according to different product categories, the tax rate ranging from 5% -200%, such as soft drinks is 13% , alcohol is 80%, cigarettes is 200%.

【Stamp Duty】 The tax rate varies according to the transaction method with a tax rate of 0.5-1%.

QHow many types of visas are available?

A【Tourist Visa】 For the first time entering Uganda, one needs to apply for Uganda's e-tourist visa on Uganda's official immigration website. After the application is successful, a printed electronic visa and payment receipt will be issued for immigration clearance at Entebbe International Airport at a price of US $ 50.

【Working Visa】 is a type of visa that permits people work legally in Uganda. Different job types have different grades, usually is CLASS G2. Prices of different years of work visa are also different, such as six months for the 800 US dollars one year for the 2500 US dollars.

【Temporary Visa】 is a valid visa for the period of handling work visa, the longest period is 8 months, is generally divided into three times (3 + 2 + 3), each passport can handle up to three temporary residence.