Uganda Tax Law

Uganda's Ministry of Finance is responsible for making national tax policies and making annual tax rate adjustments according to the needs of macroeconomic development. The Uganda National Revenue Agency (URA) is the governing body of government administration to collect various types of tax revenue. The Inland Revenue Department (IRA) has established the Internal Revenue Service, the Customs Department and the Investigation Bureau to administer various taxes. The main types of taxes include corporate and personal income tax, customs duties, urban construction tax, withholding tax, value added tax, consumption tax and stamp duty.

【Enterprise and personal income tax】 In Uganda natural person needs to pay income tax. According to the Uganda tax law, natural persons who need to pay income tax include individuals, partners, companies, trust funds and so on. The corporate income tax rate is 30%. The personal income tax threshold is 235,000 Ugandan shilling (about $ 65) a month, with a progressive tax rate of 10%, 20%, 30% and 40%.

【Tariffs, Urban Construction Taxes and Withholding Taxes】 The import stage involves import duties, urban construction tax and withholding tax. According to the different types of goods, tariff rates ranges from 0-25%, urban construction tax is 1.5%, withholding tax is 6%.

【Value Added Tax】 Companies with taxable annual sales of more than 150 million shunts (about $ 41,500) are considered general taxpayers and are subject to VAT registrations and a monthly VAT declaration. The VAT rate is 18%.

【Consumption Tax】 tax rates vary greatly according to different product categories, the tax rate ranging from 5% -200%, such as soft drinks is 13% , alcohol is 80%, cigarettes is 200%.

【Stamp Duty】 The tax rate varies according to the transaction method with a tax rate of 0.5-1%.

Uganda Labor Law

Businesses that invest in Uganda must hire local workers. Although the Ugandan economy lags behind, people's legal awareness is not weak. In order to reduce the labor disputes that occur in employment, it is necessary to have a preliminary understanding of the labor law in Uganda. Follows will introduce some aspects need to pay attention

First. Labor contracts

Each company who employs a local employee should sign a labor contract, the contract should include the following elements:

Second. Working hours and overtime pay

Third. Statutory holidays and annual leave

Fourth. sick leave

Fifth. Child labor is not allowed

Sixth. End work relations

Uganda's basic wage and tax situation

Uganda' labor force is one of the easiest to hire in the world and one of the lowest wage countries in the world. In Kampala, office staff in urban areas are basically highly educated, so they have a good foundation of English, their average monthly wage is 600,000 / = (equivalent to ¥ 1200); grass-roots workers generally have English education, so the basic communicating in English is not a problem, their average monthly wage is 250,000 / = (equivalent to ¥ 500). Outside of Kampala, for example, the MUKUNO area where Tian Tang Industrial Park is located has a significantly lower level of education than the capital, so the relative wage level is also lower than that of the capital. The wages of factory workers range from 300,000 / = to 450,000 / = (from ¥ 600 to ¥ 900), while grassroots workers earn between 200,000 / = and 250,000 / = (from ¥ 400 to ¥ 500).

The local government in Uganda has ordered companies to pay workers for personal income tax (PAYE) and social security (NSSF). The starting base of personal income tax is 235,000 / =, there are different calculations depending on the amount of wages. Social security is paid by individuals for 5% of their total salaries and paid by the company for 10% of the total. The specific calculation method is as follows:

Suppose employee salary is A.

A <235,000, no PAYE need to be paid; company pays NSSF = A * 10%

235,000≤A <335,000, PAYE = A * 10%; company pays NSSF = A * 10%

335,000 <A <410,000, PAYE = (A-335,000) * 20% + 10,000; company pays NSSF = A * 10%

410,000 ≤ A, PAYE = (A-410,000) * 30% + 25,000; company pays NSSF = A * 10%

Every year, Uganda has a large number of university graduates who inherit the British education system and can provide high-quality training. It is a regional human resources training base in East Africa, including information technology.

Uganda is also one of the best countries in Africa to speak English. Good English language skills are fundamental to managing your global investment.

However, although local labor resources are abundant and low in price, they lack basic skills and can only engage in simple physical labor. The workers are inefficient, poorly responsible and require greater supervision of their work; technicians and management personnel are severely lacked and can only be supplemented by hiring foreigners.

Visa status

1.Tourist visa

First-time entry Uganda needs to apply for an e-tourist visa to enter Uganda on the official website of the Uganda Immigration Bureau.https://visas.immigration.go.ug/After successful application, take the printed electronic visa and payment receipt to handle entry procedures at Entebbe International Airport.

Documents required to apply for a tourist visa:

2.Working visa

This is the visa type that allows legal work in Uganda. There are different levels according to different types of jobs. However, most corporate applications are CLASS G2. The cost of applying for a work visa is as follows:

Residence deposit: $ 1,034 / person. The original deposit receipt shall be returned after the immigration office finishes the deposit formalities or finishes the formalities of working visa.

Price list of different years working visa:

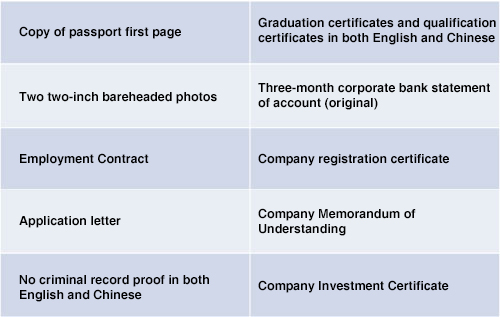

Documents to be provided:

The wife and children of a man who holds a working visa can apply for relatives residence if they want to live or attend school locally. Need to provide following material when apply for relatives residence:

Copy of marriage certificate of husband and wife in both English and Chinese (child's birth certificate in both English and Chinese)

Two two-inch bareheaded photos of wife or child

Passport first page and visa copy of the people who has working

Visa Original passport of wife or child, passport first page copy of wife or child

4.Temporary visa

Special pass covers up to a maximum of 8 months, generally divided into three times to handle and divided into 3 +2 +3, a passport can handle up to three times of temporary residence.

This kind of visa is a kind of legal visa that is signed when someone has no working visa but is applying for working visa, which is equivalent to a temporary work visa. Application for temporary visa only needs to provide the company name.

5.Tourist visa extension

If the tourist visa has not expired and need to postpone for study or tourism , you can apply for two months of tourist delays, the application can be applied up to twice in a row, and cannot be found to work in Uganda, if found, the people will be arrested.

Uganda Investment Law

The investment authority of Uganda is the Uganda Investment Authority (UIA), which was established under the Investment Law in 1991 to promote and support foreign investors to invest in Uganda. Their responsibilities include: Strive to make Uganda a ideal choice of foreign investor; 2 , help investors achieve their investment willingness by providing professional advice and support; 3, award investment permits and preferential investment certificates; 4, assist investors to obtain other approvals and permits; 5) present attracting foreign investment policies, suggestions and plans to Uganda government; 6, help potential investors in Uganda to select and establish investment projects; 7, accept complaints, supervise implementation of investment law.

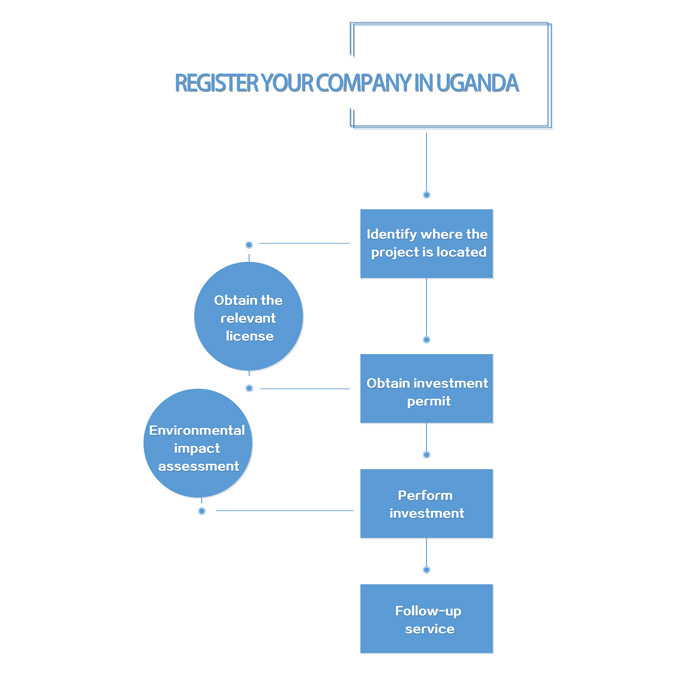

Uganda Investment Authority provides investors with one-stop service center where investors can apply for business registration, licensing, investment promotion measures and follow-up services. The first step of eligible investment in Uganda is company registration, investment permits can be obtained after registration is completed. The investment capital of a foreign company should exceed 250,000 U.S. dollars and the local company's investment capital should exceed $ 100,000. Applying for an Investment Permit from the Investment Authority can be done online. Once all relevant documents and completed application forms have been submitted, you will receive a free investment permit within 2 days. Some areas require the approval of the relevant regulatory agencies, including: power generation, mining, bank, aviation, pharmaceuticals, education and health. Investors need to obtain the approval / permit / certificate of the relevant regulatory agency before applying for the investment license.Specific details can be found at www.ugandainvest.go.ug or www.ugandainvest/index.php/one-stop-center.

Banned industries: weapons, military equipment and ammunition.

Restricted industries: Foreign investors must obtain investment permit issued by relevant departments of the government if they want to invest in fields such as finance, insurance, airports, legal services, aviation and rail transport, tourism, mining, oil exploration and development, hydropower, forestry, medicine and hospitals, radio and television program.

Encouraged industries: Uganda encourages investments in fields such as agriculture, infrastructure, energy and education. The Investment Law promulgated in 1991 encourages investments in 24 areas: (1) food processing industry; (2) forestry product processing industry; (3) fish processing industry; (4) steel industry; (5) chemical industry ; (6) Textiles and leather industry: (7) oil extraction industry; (8) paper products industry; (9) mining industry (10) glass and plastic products industry (11) ceramics industry (12) machine tools, tools, equipment and machinery manufacturing industry (13) industrial spare parts processing industry (14) (15) meat products processing industry (16) tourism industry (17) real estate development industry (18) building materials industry (19) packaging industry (20) transport industry (21) energy-saving industry ;(23) Banking; (24) High-tech industries.

Foreign investors do not enjoy the preferential policies in the following fields: (1) wholesale and retail trade; (2) personal service industry; (3) public relations industry; (4) car rental and taxi industry; Bakery, confectionery and food processing industries; (6) postal and telecommunications; (7) professional services.